Meet The Brunner Investment Trust Portfolio Managers

The Brunner Investment Trust is managed by two highly experienced portfolio managers supported by two senior deputies, with the direct management team collectively having almost 100 years of investment experience. The portfolio managers are supported by the broader Allianz Global Investors platform, with investment resources around the world, covering analysis, research and company engagements.

At your fingertips

The Brunner Investment Trust: A history

The Brunner Investment Trust has been in existence for almost a century, having been created by the Brunner family in 1927. Their forefather, Sir John Brunner, a noted British industrialist, had established Brunner, Mond and Co. in 1873, and he grew it into a major manufacturer of soda ash (which is an industrial ingredient used in the manufacture of a wide range of products, from glass to detergents to lithium-ion batteries). In the years following his death in 1919, the Brunner family merged the business with three other British chemical companies to form Imperial Chemical Industries (ICI). When the family sold their shares in the combined business, in 1927, they established Brunner Investment Trust to manage their wealth in a long-term oriented investment vehicle.

Today, the Brunner family remain significant shareholders of the trust, and the aim of the trust hasn’t changed: it’s an 'all-weather' portfolio for investors looking for long-term global growth opportunities and a regular dividend.

What is an investment trust?

An investment trust is a company whose purpose is to invest shareholders capital in stocks, bonds, cash, or alternative assets, with the aim of generating long-term capital growth for their investors. The legal structure of an investment trust is typically a public limited company (PLC), the most common form of entity for large businesses. Investment trusts are closed-ended funds, which means there’s a finite number of shares which investors buy and sell. These shares are typically traded on stock exchanges, similar to shares in ordinary companies. Brunner is listed on the London Stock Exchange, and is a member of the FTSE 250.

Unlike open-ended funds, where the investment manager is required to sell assets to meet investor demands, the closed-end fund structure – where selling investors transfer their shares to other investors rather than back to the manager as happens with open-ended funds – means a trust’s managers are never forced to sell assets at inopportune economic moments to meet investor demands. The managers can therefore truly invest for the long term.

As a PLC, Brunner has an independent board of directors whose role is to appoint the portfolio managers, set the investment strategy and ensure it is adhered to. The board acts in the interests of the shareholders (investors). Brunner’s board is highly experienced, enabling them to provide investors with not only the reassurance of diligent checks and balances, but also knowledge and insights across various fields of expertise. A small fee is levied by the trust which covers the services of the portfolio managers, and the various administration costs of trading and running the fund, the current fee level is stated on the website and the trusts’ factsheets.

What are the objectives of The Brunner Investment Trust?

The Brunner Investment Trust has a dual objective of delivering long-term capital growth while paying a rising dividend to shareholders. We aim to deliver this objective in most economic conditions (certainly relative to our benchmark), which is why we describe Brunner as an ‘all-weather’ portfolio. We aim for it to serve as a strong backbone to any investor’s diversified portfolio.

Brunner’s global equity remit provides the freedom to invest in companies from all over the world and across every sector of the economy. From an investment universe of roughly 6,000 companies, we hold approximately 60 in the portfolio, the majority of which have market capitalisations (the stock market’s valuation of a company) greater than $10 billion. We seek out the best opportunities for growth and reliable dividends, wherever they may be.

The sterling benchmark against which Brunner’s performance is measured includes both global (FTSE World ex-UK, with a 70% weight) and UK components (FTSE All-Share Index, with a 30% weight). This benchmark gives Brunner a unique blend of international exposure while maintaining a connection to UK markets. We aim to capture opportunities across a broad spectrum of geographical locations and sectors, with a ‘best of both’ approach. We aim to achieve a higher return than the benchmark, after costs, and to deliver steady dividend growth (ideally ahead of inflation).

How The Brunner Investment Trust finds its investment opportunities

Our global, all-weather equity remit means we scour every region and sector around the world for the most attractive opportunities. With the help of Allianz Global Investors’ geographical reach and investment platform, we aim to identify the most attractive opportunities for the Brunner Investment Trust. We review the fundamentals of each individual company through the lenses of quality, growth, and valuation (as discussed below), rather than selecting companies according to broader market conditions or themes. We believe that the key to delivering good returns in all market environments is constructing a balanced portfolio of attractive investment opportunities which is diversified across a range of risks, sectors and geographies.

We typically are invested in around 50-60 companies at any time. The size of each investment within the portfolio reflects our level of conviction, which is our balanced judgement of the quality, growth, and value of each investment relative to the other opportunities we have.

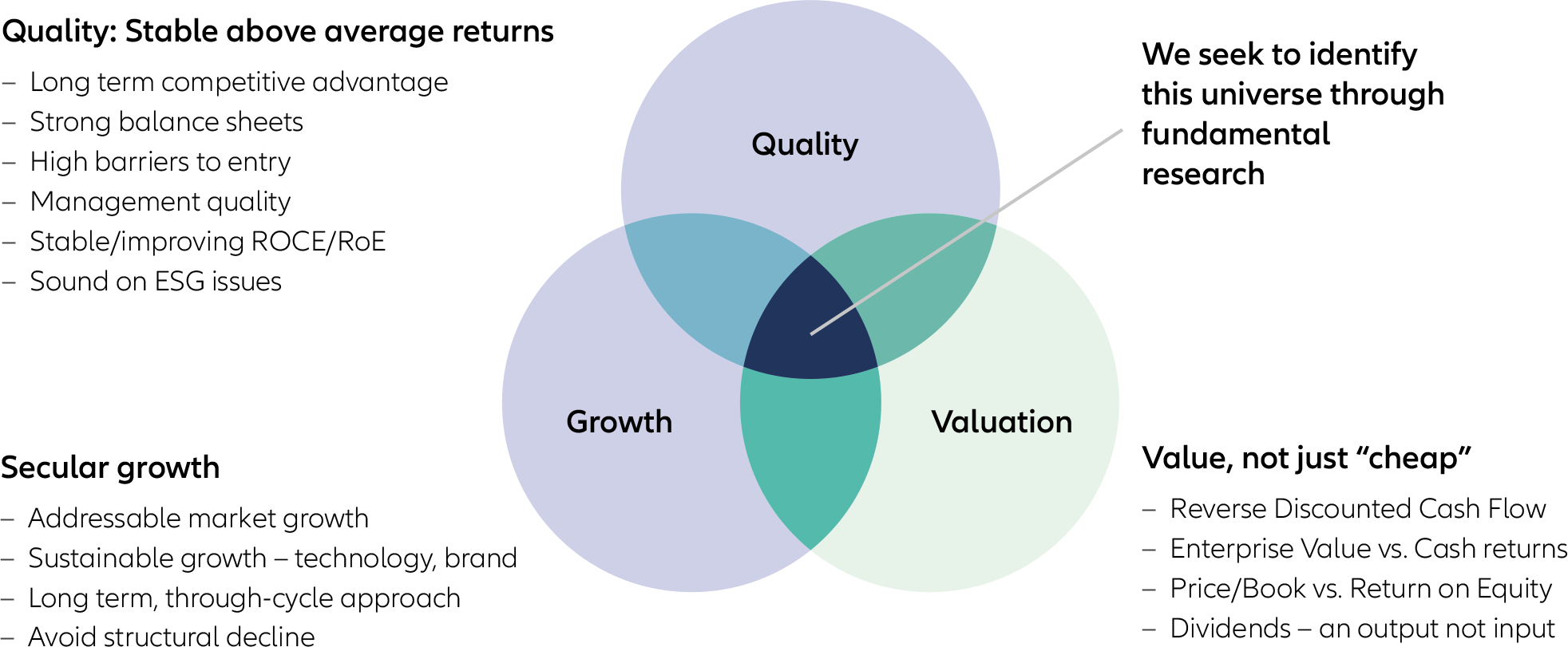

Quality, growth, and valuation

We analyse companies by assessing business quality, long-term growth potential, and valuation. These three factors build a holistic view of a company, any associated risks, and the drivers of shareholder value over the long term.

To assist in this process, we draw on Allianz Global Investors’ large global team of analysts, who provide us with high-quality insights across a range of sectors and geographies. They help us understand relevant structural trends and competitive factors, while assisting us in assessing the sustainability of a company’s cash flows over time.

Business quality

Business Quality is one of our three focus areas when assessing a company as a potential investment for the Trust. To us, Quality is about understanding the intrinsic attributes of a business model, and the ability of a company to earn high returns on invested capital over a sustained period. Such companies typically have clear competitive advantages, such as network effects, irreplaceable intellectual property, strong brands, or high customer switching costs. Businesses with high returns on invested capital are highly profitable, generating substantial cash flow that can be used to fund further, value-creative growth or returned to shareholders as dividends or buybacks.

The importance of high returns on capital was well illustrated by the late Charlie Munger, who was Warren Buffet’s business partner for half a century. Buffett and Munger have a wonderful ability to explain complex theories in simple, concise ways. Munger’s view of the importance of business quality when investing is one such case:

“Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that for 40 years, you’re not going to make much difference than a 6% return – even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive-looking price, you’ll end up with a fine result. So, the trick is getting into better businesses.”

We primarily look for businesses with high returns on capital, and focus intensely on ensuring that these returns are sustainable over time. As well as high returns, we also look for high quality, and shareholder-friendly, management teams, and companies with strong balance sheets.

Long-term growth potential

We also assess the long-term growth potential of investment opportunities. While we don’t invest based on 'themes’, we do try to understand the long-term trends that are shaping both individual industries (for example, the growth in ecommerce within retail) and the economy and society more broadly (for example, demographics and digitalisation). This provides the context in which to assess broader industry drivers as well as a company’s position within the industry. While we like businesses with strong growth, we generally avoid ‘hyper growth’ businesses who are at an early stage of their life cycle: in most cases we think it is too difficult to assess what the long-term growth and profitability of these businesses will be. At the other end of the spectrum, we tend to avoid companies operating in industries in structural decline.

The combination of a high-quality business model and long-term growth is a particularly powerful driver of shareholder value. Historically, many of the world’s truly great equities have enjoyed these twin attributes.

Company valuations

Once we have got comfortable with the quality and growth potential of a company, we need to come to a view as to what we would be willing to pay for it. Company valuations help us determine whether there is sufficient upside to warrant investing, or whether the market price is not dissimilar from our own assessment of what we would pay for the company. We look for businesses where the quality and/or long-term growth potential is not fully appreciated.

Our goal is to build a balanced, all-weather portfolio, which optimises for aggregate quality, growth, and value. Our focus is on understanding how a business evolves and creates value over the long term, and its opportunity for future growth. It’s only over longer periods that the fundamentals of a business or industry reveal themselves, and the power of compounding takes place.

Why compounding matters in investing

Albert Einstein reputedly called compound interest the eighth wonder of the world. We can demonstrate its power using two hypothetical businesses: Business A and Business B. Business A earns just 6% on its invested capital and reinvests all the cash it generates back into the business. If this business generates $100 of profits in the first year, 10 years later the reinvestment will have increased annual profits to $169.

Like Business A, Business B also reinvests all the cash it generates back into the business, but this company has a much higher return on capital: 25% and. If this business generates $100 of profits in the first year, 10 years later the wonder of compounding on the profit reinvestment will have increased annual profits to $745.

After 20 years, Business B’s profits will have grown to over $6,900, while Business A’s profits will have just passed $300. Virtually all the world’s great equities have been Business Bs: companies with high returns on capital, and the ability to deploy significant additional capital to drive long-term growth.

Truncating this growth by insisting on premature dividends could be unwise, and is one of the reasons we don’t exclusively target high dividends. A small cohort of high-return, growth businesses can deliver exceptional outcomes for shareholders over time. Through detailed research and analysis focused on what truly matters, we seek to deliver superior investment returns. Patience is a prerequisite for participation.

What does value mean in investing?

Academic Vaclav Smil calls steel, ammonia, cement, and plastic the ‘four material pillars of modern civilisation’. Without these products, society couldn’t function. Yet their direct contribution to global GDP and stock market value is negligible.

The counterintuitive conclusion we reach is that just because something is important doesn’t mean it’s valuable. This statement also works in reverse. The second most valuable company in Europe, Louis Vuitton Moet Hennessey (LVMH), derives most of its profit from the sale of handbags, which may be important to some but probably wouldn’t be classified as crucial for society’s functioning. Just because something is valuable, doesn’t mean it’s important.

This paradox is manifest throughout the stock market. Many long-term studies show the correlation between gross domestic product (GDP) performance and stock market performance is non-existent, or even negative. In other words, they don’t move together - their performance diverges.

As GDP represents the pool from which firms can derive profits, this is counterintuitive. In our view, this reflects the reality that strong profitability, and therefore stock market value, accrues in relatively obscure niches which make a relatively immaterial direct contribution to GDP.

For example, the US accounts for 70% of the world stock market value despite only accounting for 25% of world GDP. Simplistically this is because, in aggregate, US firms have grown faster and with higher returns on invested capital than those elsewhere in the world.

In a similar vein, Volkswagen’s sales - and therefore direct GDP contribution - are higher than Microsoft’s. Yet the software behemoth’s $3 trillion market value is more than sixty times that of VW, which has a market cap of just $50bn despite its enormous sales base.

Microsoft is hugely profitable, growing, and well-governed. By contrast, Volkswagen operates in a highly competitive, mature market. Despite its size and importance, particularly to the GDP of Germany, VW has rarely created value for its shareholders despite its ability to create well-engineered cars.

Many of Brunner’s holdings, such as Microsoft, operate in profitable niches. We pay particular attention to the competitive environment and market structure as these tend to be key determinants of a company’s ability to generate high returns. Businesses with unique assets or abilities are of particular interest. It’s businesses such as these that can reinvest their cashflows at attractive rates of return, creating value for shareholders along the way.

A security mentioned as example above will not necessarily be comprised in the portfolio by the time this document is disclosed or at any other subsequent date.

What shapes The Brunner Investment Trust’s Investment Decisions?

A study by Hendrik Bessembinder, a finance professor at Arizona State University, found that half of all wealth generation by US stocks between 1926 and 2019 came from fewer than 100 stocks: a tiny fraction of the overall universe. It is the combination of high returns and growth that helps explain why a small subset of extraordinary businesses has been able to deliver incredible stock market performance, and why that small subset of businesses has come to dominate stock market value in a way that doesn’t necessarily correlate with their real-world importance. Value accrues in niches. Most businesses are prone to competition which keeps profitability in check.

Brunner is proud to have owned many of the great businesses of our time, those that have delivered exceptional results for shareholders. Companies like Microsoft and UnitedHealth in the US, LVMH, Novo Nordisk and ASML in Europe, and TSMC in Asia, have all married high returns on capital with high rates of growth, to outstanding effect.

Our investment approach continues to hunt for these rare entities, whilst always remaining mindful of valuation and never veering into speculative territory. For us, it’s the quality of the company that matters, not its location, so we favour large, well-financed businesses with global reach, pricing power and brand strength.

We take a balanced, all-weather approach, without being beholden to any particular investment style. Our potential investment universe is worldwide, as we seek opportunities for growth and reliable dividends wherever they may be. We believe this is a timeless way of running money and one that should continue to pay literal dividends over the long-term.

What are the benefits of The Brunner Investment Trust for investors?

Brunner aims to generate capital growth and a rising income for investors, across a broad range of market conditions, which is why we describe it as an ‘all-weather’ approach. In other words, we aim to deliver steady and consistent capital and income return, ahead of our benchmark. We believe Brunner’s long-term, balanced nature and global remit can make it the cornerstone of any investor’s diversified portfolio. Despite the economic volatility and broader societal challenges experienced over the past five years, Brunner has outperformed its benchmark in each year, after paying fees and expenses (for more information, please refer to the dedicated performance section).

Although past performance is no guide to the future, the trust has paid increasingly higher dividends to its shareholders year-on-year for the last 52 years. A healthy revenue reserve, prudently accumulated by the board during good years, meant the dividend was increased even during the COVID-19 pandemic, when economic uncertainty and market turmoil led many companies to cut dividends. Holding back some income to smooth dividend payments over the years is a unique feature of investment trusts.

This stellar dividend track record began in 1972, with a payment of 0.48 pence per share to shareholders. Over half a decade later, Brunner’s regular rising dividend has made it one of the Association of Investment Company’s ‘Dividend Heros’. 1

The trust’s income payments help cushion investors from more volatile market conditions, increasing its investor appeal during economic downturns. We are proud of our dividend record, which shows that even in the face of potential share price uncertainty and volatility, Brunner still aims to deliver a growing income stream.

Environmental, social and governance performance

We believe that good Environmental, Social and Governance (ESG) attributes at a company contributes to long-term shareholder value. We therefore incorporate ESG risk considerations into our investment process and monitor the ESG risks for each holding.

Good Governance influences our assessment of business Quality, for example. Environmental factors may present opportunities for growth or threats to long-term business values (the projected future value of assets). Allianz Global Investors’ (Brunner’s investment manager) sustainability research team is fully integrated into the broader investment research platform, allowing the Brunner team to develop a deep understanding of these risks and opportunities. As long-term investors, these considerations are critical to the investment process.

Stewardship and engagement with our companies on ESG matters is also important to us. We believe we have a duty to engage with the boards and management teams of the companies in the portfolio. This is not purely about holding management to account, but also about influencing company strategy and promoting effective governance, to help improve long-term performance. We focus on the sustainability of the business model and factors such as the environmental impact of the business, social policies, and capital management.

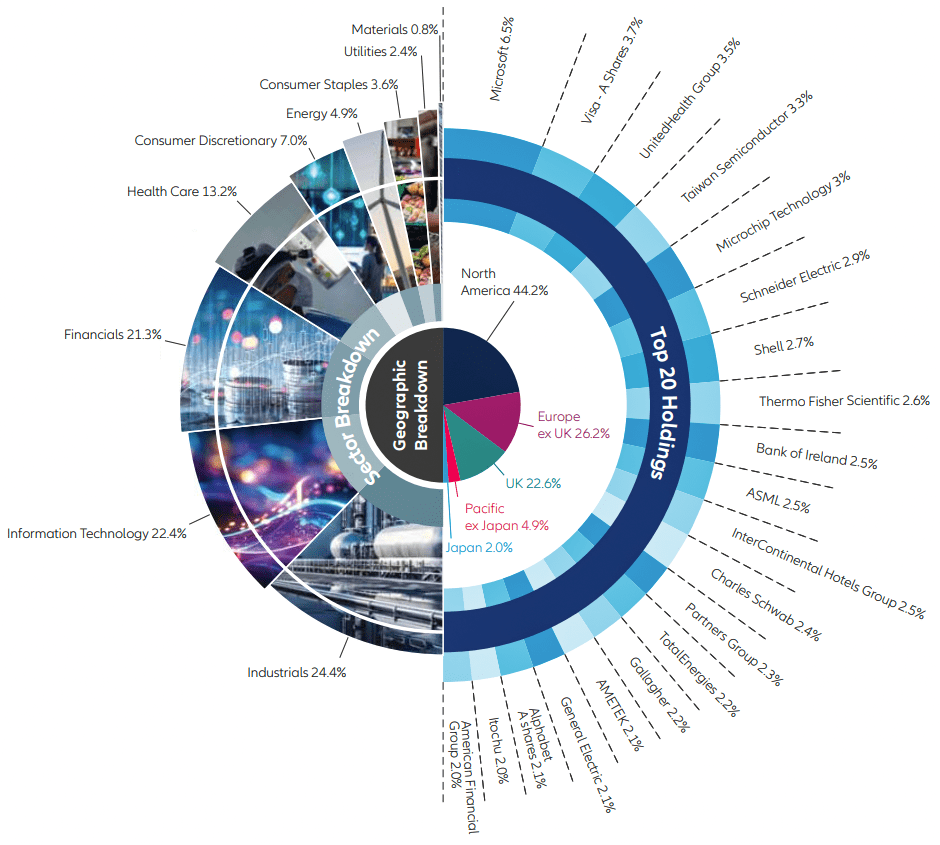

A Typical Breakdown of The Brunner Investment Trust’s Top Holdings

Source: Top 20 Holdings: Data as of 31.05.2024.

Sector Breakdown: Data as of 31.05.2024. Excludes Cash

Geographic Breakdown: Data as of 31.05.2024. Excludes Cash

The Brunner Investment Trust performance

We often describe Brunner as an ‘all-weather’ global equity portfolio, which aims to deliver strong capital and income growth through a variety of market and macroeconomic conditions.

Against the volatile backdrop of the past five years - including a global pandemic, increasing geopolitical tensions and higher inflation – Brunner’s performance (after fees and expenses) has exceeded its benchmark in each year. Over the five years to the end of May 2024, the value of trust increased 81%, significantly ahead of the 69% increase in the benchmark over the same time period.

The calculation is based on the net asset value per unit/share (front-end load in the first year of investment deducted) assuming distributions were reinvested. Calculation according to BVI method. The performance in this model calculation is based on an invested amount of EUR 1,000 and is adjusted for the following expenses: front-end load of XX% (invested amount reduced by EUR XX.XX on the date of the subscription) in the first year of investment. The management of the account may involve annual custodian fees, which will reduce the performance. Past performance does not predict future returns.

Conclusion

We can’t predict the weather, and markets are similarly very hard to anticipate. That’s why it’s good to have a trust like Brunner as a backbone to any investment portfolio, because it’s built for all market conditions. No matter what metaphoric rain, sleet, sunshine, or gales the market may throw at us, Brunner aims to deliver a rising dividend and capital growth.

-

The statements contained herein may include statements of future expectations and other forward-looking statements that are based on management's current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. We assume no obligation to update any forward-looking statement.

Securities mentioned in this document are for illustrative purposes only and do not constitute a recommendation or solicitation to buy or sell any particular security. These securities will not necessarily be comprised in the portfolio by the time this document is disclosed or at any other subsequent date.

This is a marketing communication. Please refer to the Key Information Document (KID) before making any final investment decisions.